BSP warns oil risk plus peso depreciation may push inflation over 5%

The Department of Energy warned domestic pump prices could increase by P5 per liter next week if global oil prices continued to soar as Israel and Iran have been exchanging deadly strikes and apocalyptic warnings for seven days now.

DOE Oil Industry Management Bureau (OIMB) director Rodela Romero on Friday said based on the 4-day trading in Mean of Platts Singapore, the benchmark trading of oil importers, gasoline is already poised to increase from P2.50 to P3 per liter, diesel from P4.30 to P4.80 per liter and kerosene from P4.25 to P4.40 per liter.

“Major oil price shock looming as Israel – Iran conflict threatens critical global shipping passage,” Romero said, noting that next week would be the highest oil price increase implemented by the DOE since January.

The Land Transportation Franchising and Regulatory Board, however, said it has not yet approved a new fare increase for public utility vehicles pending the outcome of an ongoing study by the Department of Economy, Planning, and Development (DEPDev), formerly the National Economic and Development Authority (NEDA).

Speculation had been swirling that Trump would throw his lot in with Israel as he said he would decide “within the next two weeks” whether to involve the United States.

Uncertainty, however, prevailed and traders remained nervous.

“Crude still calls the shots, and volatility’s the devil in the room — and every trader on the street knows we’re two headlines away from chaos,” said Stephen Innes at SPI Asset Management.

“Make no mistake: we’re trading a geopolitical powder keg with a lit fuse. President Trump’s two-week ‘thinking window’ on whether to join Israel’s war against Iran is no cooling-off period — it’s a ticking volatility clock.”

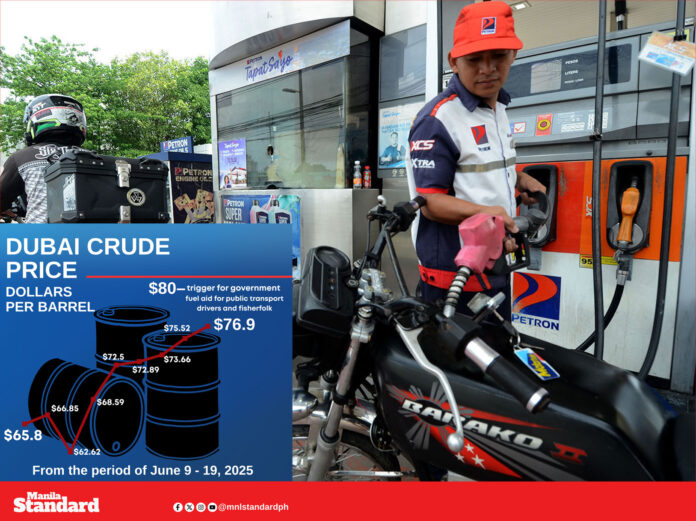

The Bangko Sentral ng Pilipinas warned consumer prices could exceed 5 percent if global oil benchmarks, particularly Dubai crude, reach $100 per barrel and the Philippine peso sharply depreciates.

BSP Governor Eli M. Remolona, Jr. said: “Oil is one of the big risks that we worry about. Those two combined would have a very big effect on our inflation.”

“We have a bad scenario, if I may call it that, in which our inflation rate could go up to, could exceed 5 percent but we hope that doesn’t happen,” Remolona said in an interview with Money Talks.

“We’re carefully watching that. Our good scenario, our central scenario, says inflation will go up to around 3.4 percent,” he added.

LTFRB chairperson Teofilo Guadiz III, for his part, said any fare adjustment is a “serious matter that requires careful study especially considering the current economic conditions.”

“We are not rushing into a decision. We are waiting for [DEPDev’s] analysis, and the Board will act based on facts and expert recommendation,” he said.

MOPS data showed the diesel prices in the world market have soared by $9.52 per barrel this week compared to last week. Kerosene also went up by $9.20 per barrel and gasoline by $5.63 per barrel.

Romero said the DOE will hold talks with oil firms early next week to appeal for a staggered implementation of the price increase.

Jetti Petroleum earlier said it is willing to comply with the staggered increase, if mandated.

The forecasted pump price increase next week will be the sixth consecutive week of increase for gasoline, the fourth consecutive week for diesel and the third consecutive week for kerosene. With AFP